Promoting Healthy Aging During Financial Literacy Month

As April marks Financial Literacy Month, it is an excellent time to start improving your financial literacy. Gaining financial savvy can help you handle the challenges and complexities of aging.…

Financial Planning: High-Net-Worth Wealth Transfer to Heirs

The great wealth transfer is underway in America. Through 2045, Baby Boomers will pass down assets worth roughly $84 trillion to Gen Z, Millennials, and Gen X. What constitutes a high-net-worth (HNW)…

Five Ways to Update Your Estate Plan After a “Gray” Divorce

Deciding to end a marriage as an older adult is increasingly common. If your marriage ended later in life, you could be part of the “gray” divorce trend. AARP reports that…

Does Your Estate Plan Include Your Pets?

Did you know that National Pet Day is celebrated on April 11th of this year? What a perfect reminder to consider your pet or pets when creating an estate plan.…

Medicaid Spend Down: Pay for More Than Just Medical Bills

Since the 1960s, Medicaid has provided health care coverage for low-income people across the United States. For millions of seniors, Medicaid offers financial assistance, helping them to cover the cost of…

Getting Help When Providing Care at Home for Aging Parents

As they grow older, your parents may prefer to continue living in their home rather than moving to a long-term care facility. They are not alone in this; more than…

40% of People Say They Don’t Have Enough to Make a Will

Four in ten people believe they do not have enough assets to make a will, according to Caring.com’s 2024 Wills and Estate Planning Study, which surveyed more than 2,400 individuals.…

Retirees: Deduct Your Long-Term Care Insurance Premium

Even if you have a long-term care insurance policy, you may likely be hoping that you won't ever have reason to use it. Regardless of what the future holds, there's…

Most U.S. Workers Say They Will File for Social Security Early

To secure the maximum amount in monthly Social Security retirement benefits, Americans must wait until full retirement age to start receiving their payouts. Results from a 2023 survey show that most of today’s workers…

Are You a Family Caregiver? New Bill Seeks to Lower Costs

Recently proposed legislation seeks to offer financial relief for unpaid family caregivers. Introduced in November 2023, the Lowering Costs for Caregivers Act of 2023 is the result of a bipartisan effort to…

Medicaid Planning Protects Your Home

Your most valuable property may be your home, which is true for many people. You likely want your children to inherit that value when you pass away. However, you may also have concerns about planning for the…

A Seniors Guide to Estate Planning

Most older adults acknowledge that estate planning is essential. Yet, nearly half of Americans age 55 or older do not have a will, and even fewer have designated powers of attorney,…

Medicare Benefits 2024: Five Positive Changes for Seniors

More than 65 million seniors across the country benefit from Medicare, a government health insurance program. When Does Medicare Start? At age 65, you become eligible for Medicare if you…

Estate Planning: Should I Divide My Assets Equally?

Your heirs may not see eye to eye on family circumstances, particularly regarding inheriting your estate. Relationships can change and intensify when you die. Underlying issues can bubble to the…

Report: The Current and Future State of Estate Planning

Over the next two decades, experts foresee Baby Boomer households transferring more than $84 trillion in generational wealth. Amid challenging economic times, it is more important than ever to protect your assets…

Baby Boomers: Inheritance Conversations with Your Children

Not talking to your adult children about their inheritance comes at a cost. Do what you can to manage expectations for adult children as they forge their financial plans. Knowing…

New Year’s Resolution: Get That Estate Plan Done

Visiting your attorney to get your estate plan done is one New Year's resolution that you should definitely keep. None of us knows whether or when we may find ourselves…

PACE Program Helps Seniors Remain at Home

Most seniors want to stay at home as long as they can instead of moving into a nursing home. The little-known Program for All-Inclusive Care of the Elderly (PACE) provides…

Can Over-the-Counter Hearing Aids Prevent Dementia?

According to the National Institutes of Health (NIH), hearing loss affects one-third of older adults. As difficulty hearing can lead to communication challenges and social withdrawal, it can also increase the risk…

14 Essential Questions to Ask Aging Parents This Holiday

About 45 percent of adults say they plan to travel for the holidays, per The Vacationer. With multiple generations getting together for holiday meals, gift exchanges and quality time, these annual gatherings…

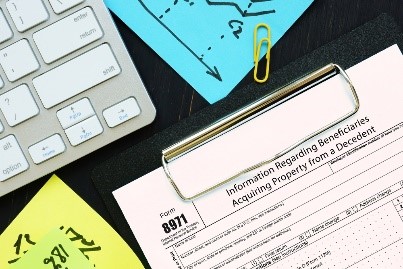

2024 Annual Gift and Estate Tax Exemption Adjustments

With the arrival of the new year, revisions to the annual gift tax and estate tax exclusions will be going into effect, as recently announced by the Internal Revenue Service (IRS). Gift…

What Will Your 2024 Social Security Benefits Look Like?

In 2023, recipients of Social Security benefits saw the biggest increase in decades in their monthly checks. Although their payouts will indeed rise again in 2024, the cost-of-living adjustment (COLA)…

Medicare Part B Premiums, Deductibles Going Back Up in 2024

In 2023, seniors were happy to see their Medicare Part B standard monthly premiums and annual deductibles go down for the first time in more than a decade. Unfortunately, that’s…

SNAP Benefits for Older Adults with Limited Income

Increasing food prices have become a concern for many Americans. If you are a senior on a fixed income, you may worry that you will not have the money to…

What Does Incapacitated Mean in Elder Law & Estate Planning?

When working with an attorney to prepare for your future and address the challenges associated with aging, you will likely come across the term “incapacitated.” Incapacitated Definition Someone who is…

Six Ways the Sandwich Generation Can Plan for The Future

Anyone experiencing the struggle of simultaneously caring for children and aging parents is part of the sandwich generation. Although “generation” is part of the phrase, it doesn’t refer to people…

How Intermediate Care Facilities Can Serve Older Adults

Many older adults can no longer safely live on their own. However, they may not need the highly specialized care of nursing homes. Intermediate care facilities present one option for…

Is Your Financial Information in Order?

Preparing and organizing your financial information for when you are no longer capable will bring peace of mind to you today. At the same time, it may relieve your loved…

What to Know About Probate: Estate Planning Basics

Most estate planning attorneys can help you craft an estate plan that minimizes or avoids probate altogether. Probate proceedings are part of the public record and can be very time-consuming…

Estate Planning for Surviving Spouses

After losing a spouse or longtime partner, it’s difficult to look past your grief. However, it’s crucial to understand the important and timely decisions you must make regarding your finances…

11 Things You Can Do Online Via the Social Security Website

The Social Security Administration (SSA) website hosts a wealth of online tools that offer you convenient access to benefits information. To make the most of these tools, simply create a my…

Ashes to Ashes, or Ashes to Soil? Is Human Composting Real?

Outlining your wishes for burial and funeral arrangements can be something you include in your estate plan. And though it may sound jarring, human composting is in fact a death…

What Is a Gun Trust: Estate Planning Q&A

According to Pew Research, 30 percent of adults in the United States report owning a firearm. Gun sales have risen in recent years, particularly during the Coronavirus pandemic. While many reported…

Why Hire an Elder Law Attorney?

Elder law attorneys may specialize in estate planning, incapacity planning, and end-of-life care for seniors. They also help older adults remain in their homes as they age and protect them…

Eight Frequently Asked Questions on Last Wills and Testaments

Starting an estate plan can be overwhelming, and you probably have many questions. You are not alone. Below are eight questions people often ask about last wills and testaments as…

What Are the Drawbacks of Naming Beneficiaries?

Although in many situations the advantages outweigh the disadvantages when selecting beneficiaries, there are always exceptions. What Is a Beneficiary? Beneficiaries are individuals who you select to receive money, various…

Home Health Services Underutilized by Seniors, Study Shows

Health Affairs estimates that 4 million older adults can only leave their homes with assistance, making accessing care challenging. The Centers for Disease Control and Prevention reports that 1.3 million Americans receive…

When Does Someone Need Financial Guardianship?

When individuals cannot manage their finances, courts can appoint guardians. Financial guardianship is for those who need help handling money. Depending on the jurisdiction, financial guardianship may also be called…

Medicare Extra Help Program Set to Expand in 2024

Seniors and disabled citizens will receive more access to the Medicare Extra Help Program as of the beginning of 2024, the federal government announced. This expansion of benefits could enable up…

Do You Need a HIPAA Release?

If you are in the hospital, you may want your loved ones to be able to access information about your prognosis. However, if you have not authorized them to receive…

Three Common Probate Questions: Estate Planning Basics

When people pass away, they leave behind assets, property, and possessions that can have sentimental and real value for surviving family members and loved ones. Everything that an individual owns…

Modifying an Irrevocable Trust Through Trust Decanting

A trust is a legal document that you can set up to give assets to someone else. Trusts can be revocable or irrevocable. If you (the grantor) choose to create…

On Medicare? What You’ll Pay for Now That the PHE Has Ended

The Biden administration officially ended the COVID-19 Public Health Emergency on May 11, 2023. Certain policies that were implemented in early 2020 during the public health emergency will now expire. As a…

Affordable Housing Options for Low-Income Older Adults

Safe housing that meets older adults’ needs is essential to healthy aging in communities. Many seniors with low, fixed incomes struggle to balance housing expenses with the costs of health…

Which Should I Choose? Nursing Home Care vs. Hospice Care

End-of-life decisions are never easy. One of the most important decisions you may make regarding health care as you age could be whether you need a nursing home or hospice…

Will Robotics and AI Be the Future of Elder Care?

Adults 65 and older constitute the fastest-growing age demographic in the United States. When it comes to elder care, this expanding population is facing a scarcity in people equipped to…

Is “Aging in Place” Right for Me?

Most older adults want to remain in their homes and communities as they age rather than move into assisted living facilities or nursing homes. For those who wish to maintain…

Why You Should Designate Beneficiaries

According to WealthCounsel, over a third of Americans have experienced or witnessed familial conflict when someone dies without an estate plan. While most people believe having an estate plan is important,…

Don’t Wait Until You’re Sick to Create an Estate Plan

In the wake of the pandemic, rising inflation, mass shooting tragedies, and other events, more people recognize that they need to plan for the future. Yet while financial planning has…

When Should I Include a Pour Over Will in My Estate Plan?

In creating an estate plan, you are proactively taking steps to ensure that your assets will be distributed according to your wishes in the wake of your death. One tool…

What is Hospice Care at Home?

Hospice care is a type of health care that patients with terminally ill conditions rely on at the end of their lives. This type of care focuses on pain management…

Bill Advocates for Seniors Who Seek At-Home Medicaid Care

Seniors who need assistance with everyday activities such as dressing, bathing, and eating are eligible for Medicaid Long-Term Services and Supports (LTSS). Unfortunately, hundreds of thousands of people who qualify…

What Is Respite Care? Can It Help with Caregiver Burnout?

It is easy to burn out when you are responsible for providing full-time care to an aging or disabled loved one. In some cases, caregiver burnout can result in resentment…

Becoming a Family Caregiver for an Ailing Loved One

Taking on the responsibility of providing full-time care for an aging or disabled loved one can be a rewarding experience. Being a primary caregiver helps you rest assured that your…

Aging Care: Six Tips for Caring for Elderly Parents

Many adult children wonder what their aging parents may need and how can they can help provide it for them. You may constantly worry about your parents or other older…

What to Know About Being a Health Care Proxy

When you assume the role of the health care proxy of a loved one, you make crucial medical decisions on their behalf. If your loved one becomes incapacitated and cannot…

What Is a Qualified Personal Residence Trust (QPRT)?

A qualified personal residence trust (QPRT) is an irrevocable trust used to achieve estate and gift tax savings. The basic idea behind a QPRT is to transfer the equity in a…

Three Things to Know About Being an Executor

An executor is a person or entity you choose to carry out your last wishes outlined in your will. Your executor should be someone you trust is responsible enough to…

Deducting Long-Term Care Insurance Premiums in 2023

Are you a taxpayer who has purchased long-term care insurance (LTCI)? Take note of your policy details and your premium amount, as you may be able to deduct the cost…

Estate Planning Basics: What Is an Executrix?

When people make wills, they nominate someone to handle their estates and carry out their wishes after passing away. These individuals are known as personal representatives, administrators, executors, or executrixes.…

Estate Planning: An At-a-Glance Overview

Estate planning, or legacy planning, entails preparing your affairs for the future, including death and other life events. While older adults might give more thought to estate planning, it is…

Assisted Living vs. Nursing Homes: What’s the Difference?

Assisted living facilities and nursing homes are long-term housing and care options for older adults. Although people sometimes use the terms assisted living and nursing home synonymously, they are distinct.…

Who Can Override a Power of Attorney (POA)?

A power of attorney (POA) is a legal agreement that gives a person (agent) the ability to act on behalf of another person (principal). A common question asked about POAs is…

Appointing an Executor? Here’s What an Executor Cannot Do

The person you name as your executor will be accountable for a number of important tasks, even in managing the administration of a small estate. This may include filing tax…

Does Power of Attorney End at Death?

A power of attorney is a powerful planning document that enables you (the principal) to give another person (the agent or attorney-in-fact) the power to act for you while you are…

What Are the Benefits of Having a Testamentary Trust?

There are various benefits to creating a testamentary trust. This article discusses the benefits of adding a testamentary trust to your estate plan. What Is a Testamentary Trust? A testamentary…

What to Do When Medicare Denies Coverage

When Medicare declines to cover your medical needs, the denial can leave you with an expensive medical bill. If Medicare refuses to cover your care, do not assume this means…

Does Medicare Pay for Assisted Living?

Assisted living facilities support older adults with daily living while fostering their independence. Individuals who do not require round-the-clock nursing but need help with everyday activities like bathing, housekeeping, medications, and…

What Does the Term “Decedent” Mean?

“Decedent” is a legal term that refers to a person who has died with unsatisfied legal obligations. At the end of their life, a decedent has some legal duties that…

IRS Raising Annual Gift Tax and Estate Tax Exclusions in 2023

Although inflation is generally nothing to be pleased about, the IRS recently announced inflation-adjusted changes to the annual gift tax and estate tax exclusions for 2023. If you are considering…

Pros and Cons of a Medicaid Asset Protection Trust

A Medicaid Asset Protection Trust (MAPT) is one option a person may consider to protect their assets from Medicaid and nursing homes or long-term care. A MAPT is an irrevocable…

After a Dementia Diagnosis: Preparing for the Future

A diagnosis of dementia, a category of diseases affecting memory and thinking that includes Alzheimer’s disease, can feel overwhelming and upsetting. You might worry that you will lose control over…

Getting Medicare Food Benefits

As people age, accessing healthy meals can become more challenging. According to Feeding America, one in five older adults was food-insecure in 2020. Some older adults struggle with affording healthy foods,…

Protecting Spouses of Medicaid Applicants: 2023 Guidelines

The Centers for Medicare & Medicaid Services (CMS) has released the 2023 federal guidelines for how much money the spouses of institutionalized Medicaid recipients may keep, as well as related Medicaid figures.…

How to Choose the Best Home Care Provider for Your Parents

Choosing the correct home care provider for your aging parents is a huge responsibility. This person will be looking after the needs of those who taught you to walk, talk,…

Caregivers Are Getting Younger, Making Planning for Long-Term Care Even More Important

As baby boomers age, more and more millennials are becoming caregivers. Many are taking on this role while just getting started in their own lives, leading to difficult decisions about…

Feds Announce New Strategy to Support Family Caregivers

The U.S. Department of Health and Human Services (HHS) has recently started to focus on finding ways to support family caregivers by assisting them with resources to maintain their health,…

When Should You Start Helping With Your Parents’ Finances?

It is tough to know when you should step in and help your parents with their finances. You may go back and forth about when to take over. Deciding whether…

What Is the Difference Between a Springing and Non-Springing Power of Attorney?

A power of attorney is a document that grants various powers and responsibilities to a trusted third party or “agent” who can act on your behalf. This document usually only…

No Will? You’re Putting Your Kids at Risk

Many people delay the conversation or thoughts of having to prepare a will. Confronting the possibility of one’s death is not easy. However, as the recent death of Anne Heche…

Majority of Adult Children Cannot Support Boomer Parents, Surveys Find

A recent survey by the American Advisors Group (AAG) finds that 55 percent of adult children say they are not financially prepared to help their Baby Boomer parents cope with rising inflation…

Can a Nursing Home Hold Friends or Family Members Responsible for a Resident’s Care?

If your loved one is entering a nursing home, you may worry whether you could be liable for their care. Under federal law, a facility cannot require a family member…

Be Cautious of Generic Health Care Proxy Forms

Doctors, nurses, and hospital staff work hard to care for their patients when they are sick or hurt. However, even when a procedure is done to save a patient’s life,…

How You Can Help Your Loved Ones by Planning Your Funeral Arrangements

When an individual passes away without a funeral plan, responsibility for arranging the funeral often falls on the deceased’s close family members, such as surviving spouses and children. Planning your…

Plan Ahead Before Seeking Nursing Home Care: Avoid Unnecessary Debt for You and Your Family

Many senior citizens may need the services of a nursing home or at-home care at some point in their life. You might assume that government assistance or health insurance will…

How Long Should I Hold on to Important Documents?

It is hard to know what documents to trash and when. Before you know it, your spare room, office, basement, or garage is overflowing with boxes of papers that all…

The Powers and Responsibilities of Representative Payees

Do you have a friend or loved one who receives Social Security and is unable to manage her payments? If so, you can request that the Social Security Administration (SSA),…

Keeping Your Emergency Contacts and Medical Information Updated for First Responders

If medical personnel are able to access your medical history during an emergency, it could mean the difference between life and death. But if, for example, you are injured, in…

When Is a Nursing Home Eviction Legal, and What Can I Do?

Nursing home evictions, or involuntary discharges or transfers, disrupt the lives of residents, leading to homelessness, separation from familial support systems, and loss of care. As federal law covers all federally funded…

What You Should Consider Before Scattering a Loved One’s Ashes

Saying goodbye to a loved one is heartbreaking. Making final arrangements can be overwhelming, and knowing what you are allowed to do to fulfill your loved one's wishes is important,…

Raoul Issues Voting Guide for People with Disabilities

To mark the 32nd anniversary of the Americans with Disabilities Act, Attorney General Kwame Raoul launched an online guide for voters with disabilities in Illinois. “Thirty-two years ago, the Americans…

What Is an Executor?

An executor is the person or institution responsible for managing the administration of a deceased person's estate. The executor (also called a personal representative) is either named in a will…

Three Estate Planning Options for Your Art Collection

Collecting art or other valuable items can be a passion for many people. Often such a pastime is more about enjoying the art or the medium itself than about ensuring…

How to Get into a Nursing Home as a Medicaid Recipient

While Medicaid helps pay for nursing home care, being admitted to a nursing home as a Medicaid recipient is not always easy. There are several ways to navigate the process,…

How to Deal with an Estranged Child in Your Estate Plan

Unfortunately, not all families get along. If you are having problems with one of your children, you may not want them to benefit from your estate. There are several strategies…

Why You May Need a Trust in Addition to a Power of Attorney

While everyone should have a durable power of attorney that appoints someone to act for them if they become incapacitated, in some circumstances it is not enough. In these cases,…

Medicare Enrollment Period Extended for Those Who’ve Been Getting a Busy Signal

Medicare is part of the Social Security Administration (SSA), so if you need to enroll in Medicare, that’s whom you contact. But in recent months, phone lines at the SSA…

Medicare Advantage Plans Often Wrongly Deny Necessary Care

In an alarming number of instances, private Medicare Advantage plans are denying coverage for medical services that would be covered under original Medicare, according to a federal investigation. These denials are…

Requiring Adult Children to Pay for Aging Parents’ Care

Did you know you could be responsible for your parents' unpaid bills? More than half of all states currently have laws making adult children financially responsible for their parents, including…

What Is Undue Influence?

Saying that there has been "undue influence" is often used as a reason to contest a will or estate plan, but what does it mean? Undue influence occurs when someone…

When to Leave a Nursing Home and Move Back Home

Leaving a nursing home to return home is a goal for many residents and their families, but it requires careful consideration. While returning home is a good move for some,…

“Difficult” is Not a Diagnosis: What to Do When You’re Loved One is Being Pushed to Take Antipsychotic Drugs

“Difficult” is not a diagnosis and it is inappropriate to label any resident this way. Actions and behaviors are a form of communication by which residents are expressing an unmet…

When to Avoid Naming a Trust as Beneficiary of Your Retirement Plan

Naming a trust as a beneficiary of your retirement plan can be a good idea in some circumstances, but it can be dangerous if you are worried about creditors coming…

What to Do If Your Medicaid Application Is Denied

If you apply for long-term care assistance through Medicaid and your application is denied, the situation may seem hopeless. The good news is that you can appeal the decision. Medicaid is a…

Should You Prepare a Medicaid Application Yourself?

Navigating the Medicaid application process can be complicated, especially if you are applying for long-term care benefits. Hiring an attorney to help you through the process can be extremely helpful.…

Home Health Aide Costs See the Sharpest Increase in Annual Long-Term Care Survey

Long-term care costs climbed again in 2021, with rates for home health aides and homemakers seeing the sharpest rises, according to Genworth’s annual Cost of Care Survey. The coronavirus pandemic continues…

Claiming Social Security Benefits at Age 70

If you are about to turn 70, congratulations on reaching a big milestone. And if you also have delayed claiming Social Security retirement benefits up till now, you are joining…

Biden Proposes Major Nursing Home Reforms, Most Extensive “In Decades”

The Biden administration has announced far-reaching nursing home reforms, targeting staffing and accountability at facilities with deficient care. Advocates are calling the proposals, which include the first-ever federal minimum staffing…

Medicaid’s “Snapshot” Date and Its Crucial Impact on a Couple’s Financial Picture

When a married couple applies for Medicaid, the Medicaid agency must analyze the couple’s income and assets as of a particular date to determine eligibility. The date that the agency…

What Documents Are Required for a Medicaid Application?

Medicaid applicants must prove that they have limited income and assets in order to be eligible for long-term care services. Before beginning the application process, it is helpful to understand…

Court Rules Medicare Beneficiaries Can Appeal Switch to Hospital Observation Status

A federal court has ruled that hospitalized Medicare beneficiaries who were switched from inpatient to observation status can appeal the decision, making it easier for them to receive coverage for…

When a Social Security Recipient Dies, Survivors May Be Eligible for Benefits

When loved ones pass away, there are lots of considerations, including what happens to their Social Security. The decedent’s payments need to be stopped, but survivor’s benefits may be available…

Things to Remember at Tax Time

Tax Day, which is Tuesday, April 19 in 2022, is approaching and it is time to begin crossing T's and dotting I's in preparation for paying taxes. As tax time draws near,…

Incentive Trusts: Ensuring That an Inheritance Will Be Well Spent

Many parents or grandparents with sizable amounts of money to pass on to their heirs are apprehensive about the effect it many have on their children or grandchildren. In some…

You Can Just Say No: Declining to Act as an Agent Under a Power of Attorney

Acting as an agent under a power of attorney is a big responsibility and it isn’t something everyone can take on. It is possible to resign or refuse the position.…

Worsening Nursing Home Staffing Crisis Taking a Devastating Toll on Residents, Their Families and Hospitals

Overwhelmed by the stress of long hours, low pay and exposure to the COVID-19 virus, nursing home workers are quitting in record numbers. The labor hemorrhage has turned what was…

Estate Planning for a Single Person

If you are single, you may not think you need to plan your estate, but single people are in as much need of a plan as anyone else. Estate planning…

The Difference Between Elder Law and Estate Planning

Elder law and estate planning serve two different -- but equally vital -- functions. The main difference is that elder law is focused on preserving your assets during your lifetime,…

What It Means to Need ‘Nursing Home Level of Care’ for Medicaid Eligibility

When applying for Medicaid’s long-term care coverage, in addition to the strict income and asset limits, you must demonstrate that you need a level of care typically provided in a…

Living with Honor: Veteran’s Benefits May Help Pay for Long Term Care

Certain eligibility requirements, such as a valid discharge, at least one day of service during a war time period, and 90 days of consecutive active duty are needed to qualify…

Consider Your Sources Part Two – Understand the Terms

Many companies sell online forms, such as powers of attorney, wills, and trusts you can download and execute yourself. Creating these “fill-in-the-blank” forms online is only appropriate in limited circumstances.…

Consider Your Sources Part One – Your Life is not a Template!

Many clients ask about doing their own Will online and most clients think their estate plan needs are “simple.” Since we rarely see a truly “simple” plan, we created this…

Who Makes Health Care Decisions If You Can’t

Being able to make health care decisions for ourselves is so important to us, but what happens if you become incapacitated and are unable to voice your opinion? If you…

Why Do I Need an Elder Law Attorney?

This is a common question that comes up when planning for the future. Let’s look at one all-to-common scenario. Your spouse has just been diagnosed with Alzheimer’s disease. What will…

What Do I Need After the Funeral?

No matter when it happens, the loss of a loved one is a moment we are often unprepared to address. You may have made many decisions related to the funeral,…

Strohschein Values

“The Experience You Require and the Compassion You Appreciate” is more than just a tagline for us. We deal with sensitive family situations every day, and our core values help…

3 by 23 & 5 by 55: Important Documents for YOUR Life

It may seem confusing when attorneys start listing the important estate planning documents you should have, but there’s an easy way to remember what you need and when… 3 by…

Hiring a Caregiver: Should You Employ One Yourself or Go Through an Agency?

Most seniors prefer to stay at home as long as possible rather than move into a nursing home. For many families, this means eventually hiring a caregiver to look after…

The Six Biggest Estate Planning Mistakes

If you’re like most people, you have the best of intentions regarding how you want your estate distributed when you die or your affairs handled should you become incapacitated. Unfortunately,…

The New Road to Retirement

Thank you to our friends at the National Academy of Elder Law Attorneys for sharing this article with us. The Social Security cost-of-living adjustment for 2022 could be 6% to…

It’s Medicare Open Enrollment Time: Is Your Plan Still Working for You?

Every year Medicare gives beneficiaries a window of opportunity to shop around and determine if their current Medicare plan is still the best one for them. During Medicare’s Open Enrollment…

Be Careful Not to Name Minors as Your Beneficiaries

Most people want to pass their assets to their children or grandchildren, but naming a minor as a beneficiary can have unintended consequences. It is important to make a plan…

Britney Spears Case Puts Renewed Focus on Guardianships and Less Restrictive Alternatives

Britney Spears’s legal fight to wrest back control over her personal and financial affairs has flooded the issue of guardianship in Klieg lights. While a full guardianship may be necessary…

How You Can End Up in Medicare’s Donut Hole, and How You Get Out

Medicare prescription drug (Part D) plans can have a coverage gap—called the "donut hole"--which limits how much Medicare will pay for your drugs until you pay a certain amount out of…

Why Everyone Should Have an Estate Plan

Do you have a will? A durable power of attorney? A health care proxy? If so, no reason to read on. If not, why not? Failure to create an estate…

The Need for Medicaid Planning

One of the greatest fears of older Americans is that they may end up in a nursing home. This not only means a great loss of personal autonomy, but also…

What Happens to Your Online Content When You Die?

More and more of the music, movies, and books we own exist only online, in digital form. What happens to these collections after the owner dies? Surprisingly, while you may…

Court Case Illustrates the Danger of Using an Online Power of Attorney Form

A recent court case involving a power of attorney demonstrates the problem with using online estate planning forms instead of hiring an attorney who can make sure your documents are…

How to Make Changes to Your Will

As life circumstances change (births, marriages, divorces, and deaths), it may become necessary to make changes to your will. If an estate plan is not kept up-to-date, it can become…

Why an Irrevocable Trust May Be Superior to Gifting

Parents and other family members who want to pass on assets during their lifetimes may be tempted to gift the assets. Although setting up an irrevocable trust lacks the simplicity…

Using a No-Contest Clause to Prevent Heirs from Challenging a Will or Trust

If you are worried that disappointed heirs could contest your will or trust after you die, one option is to include a "no-contest clause" in your estate planning documents. A…

Biden Administration Eases Recommended Restrictions on Nursing Home Visits

The Centers for Medicare and Medicaid Services (CMS) has issued new guidance on whether families can visit loved ones in nursing homes. The guidance allows indoor visitation even when the…

The American Rescue Plan Could Improve U.S. Long-Term Care

Thank you to our friends at Levin & Perconti, a nationally renowned personal injury law firm in Chicago, for sharing this article with us. Justice in Aging: How The American…

BEWARE OF COVID VACCINE SCAMS

We are pleased to pass along this important information from our friends at TC Wealth Partners of Downers Grove. Please note that COVID fraud is rapidly evolving and we urge…

The Top Eight Mistakes People Make with Medicaid

Medicaid planning can be a difficult and confusing process. The following are some common mistakes people make when planning to apply for Medicaid. Thinking it's too late to plan. It's…

Married Couples Need an Estate Plan

Don’t assume your estate will automatically go to your spouse when you die. If you don’t have an estate plan, your spouse may have to share your estate with other…

COVID-19 Vaccine: Answers for Dementia Caregivers and People Living with Alzheimer’s

The Food and Drug Administration (FDA) approval of multiple COVID-19 vaccines brings hope to many, especially those living with Alzheimer’s and dementia and their caregivers who have been critically impacted…

Using Life Insurance as Part of Your Estate Plan

Life insurance can play a few key roles in an estate plan, depending on your age and situation in life. There are two main types of life insurance: term and permanent.…

The Attorney’s Role in Medicaid Planning

Do you need an attorney for even "simple" Medicaid planning? This depends on your situation, but in most cases, the prudent answer would be "yes." The social worker at your…

Can You Visit Nursing Home Residents After They are Vaccinated?

COVID vaccines are starting to roll out to nursing homes across the country, signaling the beginning of the end of the pandemic. Once your loved one has had both doses…

Five Reasons to Have a Will

Your will is a legally-binding statement directing who will receive your property at your death. It also appoints a legal representative to carry out your wishes. However, the will covers…

What to Look for When Choosing a Medicare Advantage Plan

As Medicare premiums rise, a Medicare Advantage plan can seem like an attractive option. But if you are considering switching from Original Medicare to a Medicare Advantage plan, you need…

Paying Taxes When Selling an Inherited Vacation House

While it may seem great to inherit a vacation house, in actuality it may not be practical to keep the property, especially for tax reasons. There are many factors to…

Annuities and Medicaid Planning

In some circumstances, immediate annuities can be ideal Medicaid planning tools for spouses of nursing home residents. Careful planning is needed to make sure an annuity will work for you…

Watch Out for These Potential Problems with Life Estates

Life estates can be an excellent tool for Medicaid planning, probate avoidance and tax efficiency, but there are potential problems to look out for. Knowing the implications and risks of…

Early Withdrawal from Retirement Plan Without Penalty Expires at the End of the Year

If you are experiencing financial hardship due to the coronavirus pandemic, you may want to consider withdrawing money from your retirement account while you still can. The special exemption allowing…

Special Tax Deduction for 2020 Allows Donations of $300 to Charity Without Itemizing

As we enter the giving season, there is an additional reason to be charitable. Congress enacted a special provision that allows more people to easily deduct up to $300 in…

Do You Pay Capital Gains Taxes on Property You Inherit?

When you inherit property, such as a house or stocks, the property is usually worth more than it was when the original owner purchased it. If you were to sell…

Receiving an Inheritance While on Medicaid

For most people, receiving an inheritance is something good, but for a nursing home resident on Medicaid, an inheritance may not be such welcome news. Medicaid has strict income and…

How to Fix a Required Minimum Distribution Mistake

The rules around required minimum distributions from retirement accounts are confusing, and it’s easy to slip up. Fortunately, if you do make a mistake, there are steps you can take…

The Hazards of Do-it-Yourself Estate Planning

Many websites offer customized, do-it-yourself wills and other DIY estate planning documents. Although such products are convenient, using them could create serious and expensive legal problems for heirs. These digital services…

A Modest Social Security Increase for 2021

The Social Security Administration has announced a 1.3 percent rise in benefits in 2021, an increase even smaller than last year’s. Cost-of-living increases are tied to the consumer price index,…

Don’t Forget to Fund Your Revocable Trust

Revocable trusts are a very popular and useful estate planning tool. But the trust will be ineffective if you do not actually place your assets in the trust. Revocable trusts…

The Ins and Outs of Guardianship and Conservatorship

Every adult is assumed to be capable of making his or her own decisions unless a court determines otherwise. If an adult becomes incapable of making responsible decisions, the court…

Single? You Still Need an Estate Plan

Many people believe that if they are single, they don't need a will or other estate planning documents. But estate planning for single people is just as important as it is…

Understanding the Common Types of Trusts

A trust is a legal arrangement through which one person (or an institution, such as a bank or law firm), called a "trustee," holds legal title to property for another…

How to Divide Up Personal Possessions Without Dividing the Family

Allocating your personal possessions can be one of the most difficult tasks when creating an estate plan. To avoid family feuds after you are gone, it is important to have…

Medicare Open Enrollment Starts October 15: Is It Time to Change Plans?

Medicare's Open Enrollment Period, during which you can freely enroll in or switch plans, runs from October 15 to December 7. Now is the time to start shopping around to…

Four Steps You Can Take to Protect Your Digital Estate

While the internet makes our lives more convenient, it also adds new complications. For example, what happens to all our online data and assets if we become disabled or die?…

Can You Transfer Your Medicare and Medicaid Plans When You Move to Another State?

If you plan to move to another state, can you take your Medicare or Medicaid plans with you? The answer depends on whether you have original Medicare, Medicare Advantage, or…

Falls: An Elder Care Turning Point

Our very own Carolyn Northrop, Client Care Advocate, was interviewed recently by Gayla Zoz for a Life Care Planning Law Firms Association blog article on fall prevention. We thought you…

Which Nursing Home Rating System Should You Trust?

Choosing a nursing home for a loved one is a difficult decision and it can only be made more confusing by the various rating systems. A recent study found that…

When Should You Update Your Estate Plan?

Once you've created an estate plan, it is important to keep it up to date. You will need to revisit your plan after certain key life events, including marriage, the…

How Will the Coronavirus Pandemic Affect Social Security?

The coronavirus pandemic is having a profound effect on the current U.S. economy, and it may have a detrimental effect on Social Security’s long-term financial situation. High unemployment rates mean…

Medicare Premiums to Increase Slightly in 2021

Medicare premiums are set to rise a modest amount next year, but still cut into any Social Security gains. The basic monthly premium will increase $3.90, from $144.60 a month…

The Basics of Estate Administration

Estate administration is the process of managing and distributing a person’s property (the “estate”) after death. If the person had a will, the will goes through probate, which is the…

Caregiver Contracts: How to Pay a Family Member for Care

Although people are willing to voluntarily care for a parent or loved one without any promise of compensation, caregiver contracts (also called personal service or personal care agreement) for a family…

Ready for the World: Not Too Young for Estate Planning

Turning 18 and leaving home is an exciting time for young adults, filled with a host of new freedoms such as voting and independent living. However, it is also a…

Five Topics to Discuss With Your Spouse Before You Retire

You may have a vision for your retirement, but does your spouse share that vision? Have you done any retirement planning? Spouses often disagree about many key retirement details. It…

Long-Reviled Military ‘Widow’s Tax’ Is Finally Being Phased Out

A controversial policy that reduces the benefits of military spouses is on the way out. The so-called “widow’s tax” cuts assistance to surviving military spouses who qualify for benefits under…

Will Medicare Cover a Coronavirus Vaccine?

With the global pandemic responsible for more than a hundred thousand deaths and disrupting life across the United States, the only way for the country to return to normal is…

When Planning Your Estate, Don’t Let the Perfect Be the Enemy of the Good

There are many unknowns when planning an estate, but you can’t let the uncertainties get in the way of creating any kind of plan. Having an imperfect plan is usually…

Make Sure Your Beneficiary Designations Match Your Estate Plan

Many types of property and investments pass outside of probate and allow you to designate who will receive them after your death. It is important that these designations are kept…

May Someone With Dementia Sign a Will?

Millions of people are affected by dementia, and unfortunately many of them do not have all their estate planning affairs in order before the symptoms start. If you or a…

How to Avoid Problems as a Trustee

Being a trustee is a big responsibility and if you don't perform your duties properly, you could be personally liable. That's why it's important to hire the right people to…

States Move towards Nursing Home Immunity from Liability During Coronavirus Pandemic

Chronic understaffing. Low-wage caregivers. Difficulty containing infections. These are problems that nursing homes faced in the best of times but that have proved especially deadly as the coronavirus pandemic has…

States May Not Terminate Medicaid Benefits During the Coronavirus Pandemic

Access to affordable medical care is especially important during a global health crisis. You should be aware that federal law does not allow states that have accepted increased Medicaid funding…

Coronavirus Relief Funds Paid to Deceased Americans Must Be Returned

The federal coronavirus relief bill has sent direct emergency payments to some 150 million Americans in the wake of the pandemic. Among the recipients are possibly millions of deceased individuals,…

Seniors Affected by the Coronavirus Pandemic Have More Time to Apply for Medicare or Change Plans

The closure of Social Security offices has caused problems and worries for recently unemployed seniors who need to apply for Medicare after losing their employer coverage. In response, the federal government has…

Some Long-Term Care Facilities Are Snatching Residents’ Stimulus Checks

The Federal Trade Commission (FTC) is warning residents of long-term care facilities and their families that some facilities may unlawfully require residents who are on Medicaid to sign over their…

A Letter of Instruction Can Spare Your Heirs Great Stress

While it is important to have an updated estate plan, there is a lot of information that your heirs should know that doesn't necessarily fit into a will, trust or…

Serving as a Guardian During the COVID-19 Outbreak

Serving as a Guardian during the COVID-19 outbreak can be a challenging task. Many of the restrictions put in place to protect all of us, and especially older adults and…

What Does an Elder Law Attorney Do?

In celebration of National Elder Law Month, we hope you enjoy a summary of an article written by AgingInPlace.com, explaining the history and focus areas of Elder Law. Like so…

The CARES Act and Your Retirement Accounts

Under the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) which began on March 27, 2020, there are a number of ways that financial assistance is provided for the…

Advance Directives and End of Life Considerations in a COVID-19 World

As we learn to navigate the COVID-19 reality, filled with uncertainty, there is one thing that we can all do to take control; establishing our Advance Directives and expressing our…

The CARES Act and Your Medicaid Application

As you may be aware, the Coronavirus Aid, Relief, and Economic Security Act ("CARES Act") was signed into law on March 27, 2020. All eligible individuals are expected to receive…

Medicare is Expanding Telehealth Services During Coronavirus Pandemic

As part of its response to the coronavirus pandemic, the federal government is broadly expanding coverage of Medicare telehealth services to beneficiaries and relaxing HIPAA enforcement. This will give doctors…

Remote Signing Process During COVID-19 Pandemic

On March 26, 2020 Governor Pritzker signed an executive order aimed at helping estate planning attorneys and their clients during the COVID-19 pandemic. The order outlines a remote signing process…

Staying Connected to Family Members in a Nursing Home When Visits are Banned

The spread of the coronavirus to nursing home residents has caused the federal government to direct nursing homes to restrict visitor access, and many assisted living facilities have done the…

Medicare and Medicaid Will Cover Coronavirus Testing

With coronavirus dominating news coverage and creating alarm, it is important to know that Medicare and Medicaid will cover tests for the virus. The department of Health and Human Services…

Estate Planning in a COVID-19 Environment

Unless you are at least 102 years old, you weren’t even alive for the Spanish Flu Epidemic of 1918, much less remember it. While we do not recommend jumping on…

Estate Planning Is Essential for Unmarried Couples

While estate planning is important for married couples, it is arguably even more necessary for couples that live together without getting married. Without an estate plan unmarried couples won’t be…

Free Tax Preparation Help Is Available to Seniors

Seniors and retirees should know that they may be able to use online tax preparation software free of charge. Most low- and middle-income Americans qualify for the free tax preparation…

Caregivers Are Getting Younger, Making Planning for Long-Term Care Even More Important

As baby boomers age, more and more millennials are becoming caregivers. Many are taking on this role while just getting started in their own lives, leading to difficult decisions about…

Why Certification in Elder Law is so Important

Attorneys certified in elder law offer you something that other attorneys do not: professional expertise in the unique needs of older, maturing populations. Certified Elder Law attorneys are not just…

Understanding Revocable Trusts

Revocable trusts are an effective way to avoid probate and provide for asset management in the event of incapacity. In addition, revocable trusts--sometimes called “living” trusts--are incredibly flexible and can achieve…

Local Attorney Shares Practical Advice on Alzheimer’s in Books

By KANE COUNTY CHRONICLE ST. CHARLES —Linda Strohschein, principal attorney and owner of Strohschein Law Group, is offering free advice and information about Alzheimer's disease and dementia in her two…

New Law Makes Big Changes to Retirement Plans

President Trump has signed a spending bill that makes major changes to retirement plans. The new law is designed to provide more incentives to save for retirement, but it may require workers…

Do You Have the Right Fiduciary?

A fiduciary is a fancy legal term for the person who will take care of your property for you if you are unable to do it yourself, such as the…

Feds Release 2020 Guidelines Used to Protect the Spouses of Medicaid Applicants

The Centers for Medicare & Medicaid Services (CMS) has released the 2020 federal guidelines for how much money the spouses of institutionalized Medicaid recipients may keep, as well as related…

Medicare’s Different Treatment of the Two Main Post-Hospital Care Options

Hospital patients who need additional care after being discharged from the hospital are usually sent to either an inpatient rehabilitation facility (IRF) or a skilled nursing facility (SNF). Although these…

Most Are Taking Social Security at the Wrong Time

A new report finds that almost no retirees are making financially optimal decisions about when to take Social Security and are losing out on more than $100,000 per household in…

Understanding the Differences Between a Will and a Trust

Everyone has heard the terms "will" and "trust," but not everyone knows the differences between the two. Both are useful estate planning devices that serve different purposes, and both can…

The 2020 Social Security Increase Will Be Smaller than 2019’s

The Social Security Administration has announced a 1.6 percent increase in benefits in 2020, nearly half of last year's change. The small rise has advocates questioning whether the government is…

Strohschein Named a Community Business of the Year

ST. CHARLES -- Strohschein Law Group was the recipient of the Fox Valley Entrepreneurship Center's Community Business of the Year Award. The Fox Valley Entrepreneurship Center annually selects a business…

Estate Planning When You Have a Stepfamily

Ideally, when a second marriage joins two families together, it should be a joyous occasion that creates one bigger family unit. Unfortunately, it too often also creates inheritance fights between…

Understanding Medicare’s Hospice Benefit

Medicare's hospice benefit covers any care that is reasonable and necessary for easing the course of a terminal illness. It is one of Medicare's most comprehensive benefits and can be…

How to Use a Trust in Medicaid Planning

With careful Medicaid planning, you may be able to preserve some of your estate for your children or other heirs while meeting Medicaid's low asset limit. The problem with transferring assets…

Tips for Preventing, Detecting, and Reporting Financial Abuse of the Elderly

Reports of elder financial abuse continue to increase, and the elderly are particularly vulnerable to scams or to financial abuse by family members in need of money. It is hard…

Don’t Let Medicare Open Enrollment Go By Without Reassessing Your Medicare Options

Medicare's Open Enrollment Period, during which you can freely enroll in or switch plans, runs from October 15 to December 7. Don't let this period slip by without shopping around…

Powers of Attorney Come in Different Flavors

A power of attorney is a very important estate planning tool, but in fact there are several different kinds of powers of attorney that can be used for different purposes.…

Have Private Insurance and Are Turning 65? You Need to Sign Up for Medicare Part B

If you are paying for your own insurance, you may think you do not need to sign up for Medicare when you turn 65. However, not signing up for Medicare…

New Rule May Make It Harder for Medicare Beneficiaries to Receive Home Care

It may become harder for Medicare beneficiaries to find home health care due to a new rule from the Centers for Medicare and Medicaid Services (CMS). Although the rule changes…

Medicare Beneficiaries Need to Know the Difference Between a Wellness Visit and a Physical

Medicare covers preventative care services, including an annual wellness visit. But confusing a wellness visit with a physical could be very costly. As part of the Affordable Care Act, Medicare…

A Brief Overview of a Trustee’s Duties

If you have been appointed the trustee of a trust, it is a strong vote of confidence in your judgment and trustworthiness. It is also a major responsibility. A trust…

New IRS Impersonation Scam

Thanks to our good friend, Pete Messina, at Messina & Associates in West Chicago for making us aware of the latest IRS Impersonation scam. The IRS and its Security Summit…

How Gifts Can Affect Medicaid Eligibility

We’ve all heard that it’s better to give than to receive, but if you think you might someday want to apply for Medicaid long-term care benefits, you need to be…

Don’t Leave Children Unequal Shares By Mistake

Siblings do not always receive equal shares of a parent's estate. Sometimes the inequality is intentional and sometimes it is accidental. Regardless of how it happens, it can cause arguments…

Steps to Take in Advance of Death or Disability

No one wants to face the fact that our loved ones will not be with us forever. Facing our own mortality is frightening as well. Although none of us wants…

Tips on Creating an Estate Plan that Benefits a Child with Special Needs

Parents want their children to be taken care of after they die. But children with disabilities have increased financial and care needs, so ensuring their long-term welfare can be tricky.…

Be a Healthy Caregiver

As a caregiver, you may find yourself with so many responsibilities that you neglect taking good care of yourself. But the best thing you can do for the person you…

If You Haven’t Been Regularly Reviewing Your Estate Plan, Start When You Hit 60

How frequently you should review your estate plan depends on how old you are and whether there has been a significant change in your circumstances. If you are over age…

How to Fight a Nursing Home Discharge

Once a resident is settled in a nursing home, being told to leave can be very traumatic. Nursing homes are required to follow certain procedures before discharging a resident, but…

What a Good Long-Term Care Insurance Policy Should Include

Nursing home and long-term care costs continue to rise and it is difficult to qualify for Medicaid to pay for nursing home costs. Long-term care insurance can help cover expenses, but…

Be Aware of the Dangers of Joint Accounts

Many people believe that joint accounts are a good way to avoid probate and transfer money to loved ones. But while joint accounts can be useful in certain circumstances, they…

Medicaid Home Care

Traditionally, Medicaid has paid for long-term care in a nursing home, but because most individuals would rather be cared for at home and home care is cheaper, all 50 states…

10 Reasons to Create an Estate Plan Now

Many people think that estate plans are for someone else, not them. They may rationalize that they are too young or don't have enough money to reap the tax benefits…

How to Make Your Funeral Wishes Known

How can you make sure your funeral and burial wishes will be carried out after you die? It is important to let your family know your desires and to put…

So, You’ve Been Appointed Trustee of a Trust? Here Are 9 Do’s and 1 Don’t

Whether it's an honor or a burden (or both), you have been appointed trustee of a trust. What responsibilities have been thrust upon you? How can you successfully carry them…

Last Year for Couples to Use ‘Claim Now, Claim More Later’ Social Security Strategy

This is the last year that spouses who are turning full retirement age can choose whether to take spousal benefits or to take benefits on their own record. The strategy,…

Make Sure Your Plan Beneficiary Choices Are Up to Date

Many people periodically update their wills or other estate plans, but don't update who will receive distributions from their retirement plans (such as IRAs and 401(k)s) upon their deaths. Every…

Protecting Your House After You Move Into a Nursing Home

While you generally do not have to sell your home in order to qualify for Medicaid coverage of nursing home care, it is possible the state can file a claim…

Guns and Dementia: Dealing with A Loved One’s Firearms

Having a loved one with dementia can be scary, but if you add in a firearm, it can also get dangerous. To prevent harm to both the individual with dementia…

The New Tax Law Means It’s Time to Review Your Estate Plan

While the new tax law doubled the federal estate tax exemption, meaning the vast majority of estates will not have to pay any federal estate tax, it doesn't mean you should…

Tips on Having ‘The Talk’ With Aging Parents

If you're a baby boomer, you may already have had "the talk" with your growing children. But have you had "the talk" with your aging parents as well? That talk…

What to Do When a Loved One Passes Away

Whether your spouse has just passed away or you have lost your mom or dad, the emotional trauma of losing a loved one often comes with a bewildering array of…

Does Your Estate Plan Include Your Pets?

Have you considered your pet or pets when planning your estate? If not, you should, according to The Humane Society of the United States, the nation's largest animal protection organization.…

Estate Planning for a Vacation Home

If you are lucky enough to own a vacation home, then you need to figure out what will happen to it after you are gone. Many parents hope to keep…

Why Not Just Use an Off-the-Shelf Power of Attorney Form?

A durable power of attorney is one of the most important estate planning documents you can have. It allows you to appoint someone to act for you (your "agent"…

Tailoring a Will and Power of Attorney for Multiple States

If you own property -- whether houses, bank accounts, or vehicles -- in more than one state, do you need estate planning documents for each state? The answer is…

Long-Term Care Insurance Policyholder Wins Suit Against Company for Hiking Premiums

A long-term care policyholder has successfully sued her insurance company for breach of contract after the company raised her premiums. At age 56, Margery Newman bought a long-term care…

Keeping Track of Your Will

Once you've taken the step to create a will and get your estate plan in order, you need to figure out what to do with the will itself. It is…

Reverse Mortgages Can Pose Problems for Heirs

Reverse mortgages can be a big help to seniors needing extra cash, but they can become a nightmare for their heirs. Heirs who don't know their rights may be faced…

4 Ways to Respond When Someone with Alzheimer’s Keeps Repeating Questions

People with Alzheimer’s may repeat things…a lot Alzheimer’s disease and other dementias cause problems with short-term memory. This can lead to repetitive behaviors, like asking the same question over and…

Keeping the Jolly in the Holiday

A Caregiver’s Guide to When a Family Member has Dementia Our Friends at Elderday Center in Batavia are a great resource for families with Dementia related issues. Enjoy these tips from…

What happens if You Die Without a Will?

We all know we are supposed to do estate planning, but not all of us get around to it. So what happens if you don't have a will when you…

It’s Open Enrollment Season: Is Your Medicare Plan Still Working For You?

Do you have the right Medicare plan? It is fall, which means it is time to think about whether your current plan is still giving you the best coverage or…

11 Recent Senior Scams in the Area

Senior citizens have become increasingly attractive scam targets for con artists because they have a “nest egg,” own their home, and tend to have excellent credit. In addition, people who…

Aretha Franklin’s Lack of a Will Could Cause Huge Problems

According to court documents, legendary singer Aretha Franklin did not have a will when she died, opening up her estate to public scrutiny and potential problems. Failing to create an…

Where’s My New Medicare Card? How to Find Out the Status

The federal government has begun mailing new Medicare cards to 59 million Americans. You should keep track of when your new card will arrive and contact Medicare if you don't…

More States Asking to Eliminate Retroactive Medicaid Benefits

Arizona and Florida are the latest states to request a waiver from the requirement that states provide three months of retroactive Medicaid coverage to eligible Medicaid recipients. Medicaid law allows…

Seniors Often Must Fight for Medicare Home Health Benefits

Medicare is mandated to cover your home health benefits with no limit on the time you are covered. Unfortunately, few Medicare beneficiaries get the level of service they are entitled…

Two Documents Every 18-Year-Old Should Sign

In the midst of High School Graduation season, with all of the year end activities and parties, we have one more thing to consider. Before you send your recent graduate…

Are Medicare Advantage Plans Steering Enrollees to Lower-Quality Nursing Homes?

A new study has found that people enrolled in a Medicare Advantage plan were more likely to enter a lower-quality nursing home than were people in traditional Medicare. The study…

Be on the Lookout for New Medicare Cards

The federal government is issuing new Medicare cards to all Medicare beneficiaries. To prevent fraud and fight identity theft, the new cards will no longer have beneficiaries' Social Security numbers on…

Estate Planning and Retirement Considerations for Late-in-Life Parents

Older parents are becoming more common, driven in part by changing cultural mores and advances in infertility treatment. Comedian and author Steve Martin had his first child at age 67.…

Spending Down Assets to Qualify for Medicaid

Medicaid has strict asset rules that compel many applicants to "spend down" their assets before they can qualify for coverage. It is important to know what you can spend your…

How Will the New Tax Law Affect You?

While most of the new tax law – the Tax Cuts and Jobs Act – has to do with reducing the corporate tax rate from 35 percent to 21 percent, some…

New Yorker Article Highlights Abuses in the Guardianship System

Serious problems with the public guardianship system in the United States can lead to elder abuse, according to an in-depth article in The New Yorker titled “How the Elderly Lose their Rights.” Court-appointed…

Nursing Home Costs Rise Sharply in 2017

The median cost of a private nursing home room in the United States has increased to $97,455 a year, up 5.5 percent from 2016, according to Genworth's 2017 Cost of Care…

How to Reverse Medicare Surcharges When Your Income Changes

What happens if you are a high-income Medicare beneficiary who is paying a surcharge on your premiums and then your income changes? If your circumstances change, you can reverse those…

Now Is the Time to Review Your Medicare Options

Are you happy with your current Medicare plan or plans? Now is the time to think about whether you are in the right plan or whether a new plan could…

New Medicare Cards Coming Soon!

You asked, and Medicare listened. Medicare will distribute new cards between April 2018 and April 2019. For security purposes, your Social Security number will no longer be included on the…

HUD Makes Reverse Mortgages a Little Less Attractive

The Department of Housing and Urban Development (HUD) has announced changes to the federal reverse mortgage program. Citing the need to put the program on better financial footing, HUD will…

Using a Prepaid Funeral Contract to Spend Down Assets for Medicaid

No one wants to think about his or her death, but a little preparation in the form of a prepaid funeral contract can be useful. In addition to helping your…

Don’t Let Health Care Providers Use the Improvement Standard to Deny Medicare Coverage

Have you or a loved one been denied Medicare-covered services because you’re "not improving"? Many health care providers are still not aware that Medicare is required to cover skilled…

Long-Term Care Scorecard Finds States Have Room for Improvement

A new report finds that states have made incremental improvements in providing long-term care, but need to make more improvements in order to meet the needs of the growing number…

Take These Three Steps When Your Child Turns 18

If your child has reached the teenage years, you may already feel as though you are losing control of her life. This is legally true once your child reaches the…

Owe Back Taxes? The IRS May Grant You Uncollectible Status

Sometimes seniors find themselves owing past-due federal taxes they cannot afford to pay. Although notices from the IRS can be especially frightening, there are solutions.…

Are Trusts Still Useful If the Estate Tax Is Repealed?

With Republicans in control of Congress and the presidency, there is talk of eliminating the federal estate tax. In 2017 the tax affects only estates over $5.49 million, meaning that for…

How Medicare and Employer Coverage Coordinate

Medicare benefits start at age 65, but many people continue working past that age, either by choice or need. It is important to understand how Medicare and employer coverage work…

Relief From Medicare’s Part B Late Enrollment Penalty Offered to Some

Medicare is offering relief from penalties for certain Medicare beneficiaries who enrolled in Medicare Part A and had coverage through the individual marketplace. For…

New Protections for Nursing Home Residents

New Obama-era rules designed to give nursing home residents more control of their care are gradually going into effect. The rules give residents more options regarding meals and visitation as…

Visiting Someone with Memory Loss

By Dan Kuhn, LCSW, Vice President of Education, All Trust Home Care This month we are pleased to share an article written by our good friend, Dan Kuhn, who…

Short-Term Care Insurance: An Alternative to the Long-Term Care Variety

A little-known insurance option can be an answer for some people who might need care but are unable to buy long-term care insurance. Short-term care insurance provides coverage for nursing…

Study Finds That Social Security Workers Often Provide Incomplete Information

Americans are misinformed about many aspects of Social Security, and local Social Security offices may not be helping, according to a study by the Government Accountability Office (GAO). The study…

Dispute Between Brothers Demonstrates Need to Plan for Long-Term Care

A recent New Jersey appeals court case demonstrates how important it is for families to come up with a long-term care plan before an emergency strikes. The case involves two…

Adding to Uncertainty for Scam Targets, the IRS Now Allows Private Debt Collectors to Dun Taxpayers

In a move that could be confusing to seniors who are vulnerable to scams, the IRS will begin using private debt collection agencies to collect…

New Book Offers Guidance Through the Medicare Maze

Medicare is a mixed blessing. On the one hand, it provides guaranteed coverage for Americans over age 65 or who are disabled, and the program has improved the health of…

Aging Drivers and the Law

For better or for worse, our current culture is very car-dependant; in many places, cars are the only convenient link to the outside world. Unfortunately, as people age, driving can…

Four Provisions People Forget to Include in Their Estate Plan

Even if you've created an estate plan, are you sure you included everything you need to? There are certain provisions that people often forget to put in in a will…

Hospitals Now Must Provide Notice About Observation Status

All hospitals must now give Medicare recipients notice when they are in the hospital under observation status. The notice requirement is part of a law enacted…

Costs of Some New Long-Term Care Insurance Policies Rise in Latest Survey

A couple who are both age 60 and who purchase new long-term care insurance coverage can expect to pay between 6 and 9 percent more compared…

Trump Delays Rule That Retirement Advisers Put Their Client’s Interests Ahead of Their Own

President Trump signed an executive order calling for a review of the so-called fiduciary rule, which was intended to prevent financial advisers from steering their clients…

Is It Better to Use Joint Ownership or a Trust to Pass Down a Home?

When leaving a home to your children, you can avoid probate by using either joint ownership or a revocable trust, but which is the better method? …

Senior Citizens, Even 80-Year-Olds, Can Be Organ Donors

Have you ever wondered whether or not you can still become an organ donor, despite your age? This week's article, written by JoNel Aleccia for Kaiser Health News, explains some…

How to Deduct Long-Term Care Premiums From Your Income

Taxpayers with long-term care insurance policies can deduct some of their premiums from their income. Whether you can use the deduction requires comparing your medical expenses to…

Watch Out for Mistakes in the List of Doctors Covered by Your Medicare Advantage Plan

Medicare Advantage plans are a popular alternative to regular Medicare because the plans often offer lower out-of-pocket costs, but buyers need to make sure they know what they are paying…

For Better or for Worse, States Are Turning to Managed Care for Medicaid Long-Term Care

More and more states are switching to a managed care model when dealing with Medicaid long-term care patients, a change that has resulted in a loss of services in some…

Make Reviewing Your Estate Plan One of Your New Year’s Resolutions

Estate planning is all about five essential documents. Here they are in order of importance: The Power of Attorney for Property The most important estate planning…

Is It Better to Remarry or Just Live Together?

Finding love later in life may be unexpected and exciting, but should it lead to marriage? The considerations are much different for an older couple with adult…

5 Things to Know to Reduce Your Tax on Capital Gains

Although it is often said that nothing is certain except death and taxes, the one tax you may be able to avoid or minimize most through planning is the tax…

When Can You Delay Taking Medicare?

While you are eligible to apply for Medicare when you are 65, there are circumstances where you might not want to, particularly if you are working full…

Typical Social Security Recipient Will Get $4 Benefit Increase in 2017

The nation's more than 65 million Social Security recipients will get a 0.3 percent cost of living increase in payments in 2017. This is expected to raise the monthly payment…

Execute a Power of Attorney Before It’s Too Late

A durable power of attorney is an extremely important estate planning tool, even more important than a will in many cases. This crucial document allows a person…

Life Insurance Can Still Play a Key Role As Part of an Estate Plan

Life insurance can be beneficial in replacing lost income for young families, but as people get older, it can also serve a purpose as part of an estate…

Caregiver Apps to Help Relax

Our friends at The Naperville Senior Center shared this month’s article with us. If you haven’t learned about their Adult Day Care services, check out their website at http://www.napervilleseniorcenter.com/. …

Understanding the Tax Consequences of Inheriting a Roth IRA

Passing down a Roth IRA can seem like a good idea, but it doesn't always make the most sense. Before converting a traditional IRA into a Roth IRA to benefit…

Medicare Coverage While Traveling Within the U.S.

When people retire they often have more time to travel. Although Medicare coverage is generally not available when beneficiaries are overseas, what about coverage for those…

Revoking a Power of Attorney

If for any reason, you become unhappy with the person you have appointed to make decisions for you under a durable power of attorney, you may…

Nursing Home Residents Win Back Right to Sue

In recent years, nursing homes have increasingly asked -- or forced -- patients and their families to sign arbitration agreements prior to admission. By signing these agreements, patients or…

What Is a Life Estate?

The phrase "life estate" often comes up in discussions of estate and Medicaid planning, but what exactly does it mean? A life estate is a form…

Judge Orders Medicare Agency to Comply with Settlement in “Improvement Standard” Case and Provide More Education

Matthew Shepard, Communications Director at the Center for Medicare Advocacy shares the latest information on the “Improvement Standard” case (Jimmo v. Burwell, No. 11-cv-17 (D.Vt.)). If you are…

Most Caregivers Are Now Entitled to Minimum Wage and Overtime Pay

The federal government recently extended minimum wage and overtime protections to most home health care workers. If you are hiring a caregiver for yourself or…

When Adult Children Get Sick, It May Be Hard For Parents To Get Information

Michelle Andrews at Kaiser Health News shares a case study highlighting the importance of having HIPAA forms and Powers of Attorney properly executed for you or other loved ones…

House Democrats Introduce Bill to Raise Estate Tax Rate

Changes in Social Security Claiming Strategies Arrive Next Month

Court Approves Use of Short-Term Annuities for Medicaid Planning

Incentives to Keep Working While You Collect Social Security

Woman’s Efforts to Change Will Without Professional Assistance Backfire

Incentive Trusts: Ensuring That an Inheritance Will Be Well Spent

Who Will Inherit Whitney Houston’s Fortune Following Bobbi Kristina’s Death — and What Are the Lessons?

Know Your Options Before Signing Up for Medicare

Linda Strohschein Supports NAELA Membership Contest to IL DHS Proposed Amendments to the Bureau of Appeals and Hearings

How to Protect Your Deceased Loved Ones From Identity Theft

Obama Signs Law Requiring Hospitals to Warn of Costly Medicare Loophole

Do You Need a Lawyer to Write a Will?

Nearing 65 and in a Marketplace Plan? Medicare Is Almost Always Your Best Bet

5 Rights That Trust Beneficiaries Have

Six Ideas for Distributing an Estate’s Personal Property in a Fair Way

How Do an Estate’s Debts Get Paid?

Married Three Times, Am I Entitled to Social Security Benefits From Any of My Husbands?

Am I Financially Liable If I Sign a Nursing Home Agreement for Someone Else?

Use This Form to Avoid Loved Ones Being Denied Medical Information About You

Don’t Forget About Deducting Your Long-Term Care Insurance Premiums

Passing on Assets Outside of Probate: PODs and TODs

3 Little-Known Strategies to Maximize Social Security Benefits

Cost of Private Nursing Home Room Now Averaging $91,250

Decisions to Make for Your Power of Attorney